The solution that helps grow e-commerce sites of every size

Offering a buy now, pay later (BNPL) option to your customers can increase conversion 20-30% and average cart sizes 30-50%, according to a recent RBC Capital report. These benefits can make a big difference to any e-commerce retailer—including small and midsize businesses (SMBs).

Large retailers sometimes make headlines when they add a BNPL solution to their checkouts, as Amazon and Walmart when they partnered with Affirm. But it’s important to know that more than 102,000 other businesses also offer pay-over-time options with Affirm, including artisans, niche clothiers, tour operators, and many more.

If you’re considering offering BNPL to customers, read on for more details on what to expect when adding it to your site and how it can drive growth—regardless of the size of your business.

Ready to try the buy now, pay later solution that delivers?

Buy now, pay later is a sales trigger

Giving shoppers the option to pay over time for a purchase can be just the thing to convince them to buy, resulting in incremental conversion and sales gains. In a recent study of Affirm users, 29% said they would not have completed the purchase if Affirm wasn’t available. And nearly half (45%) would have delayed the purchase.

And don’t forget the possible gains in conversion and average cart sizes. ONDO, a socks retailer on the Shopify e-commerce platform, saw a 28% boost in conversion after offering flexible payments with Shop Pay Installments (SPI).

"I've always thought about installment payments for luxury goods or higher priced products, but I didn't think people would use it to buy it for daily apparel like socks,” said Daniel Shim, CEO of ONDO. And buy they did: Average order values (AOV) doubled on sales with SPI.

Many businesses see similar results adding BNPL at checkout. That’s because shoppers welcome this flexibility in managing their cash flow, and they will often add more items or say yes to upgrades or bundles.

After Kristin Coffin Jewelry chose to offer pay-over-time with Affirm, the owner/designer noticed that more customers were upgrading their engagement rings with accent stones and different metals. The AOV on Affirm sales rose 16%, and those sales made up 10% of her total volume.

Offer what more customers want: flexibility

Offering a pay-over-time option to shoppers is a way to give them what they want: more choice in how they pay for purchases. Consider this trend: A C+R Research study in April 2021 found that 60% of shoppers had used a BNPL service in the last year.

Flexibility is at the core of buy now, pay later. And varying the BNPL options you offer to shoppers can attract many different customers. Some shoppers prefer the option of splitting the purchase price into 4 interest-free payments made every 2 weeks. Others may prefer to make monthly payments spread out over a longer term, with or without interest.

More choice is also good for business: E-commerce sites on the Wix platform with 3 or more payment options have 39% higher sales revenue.

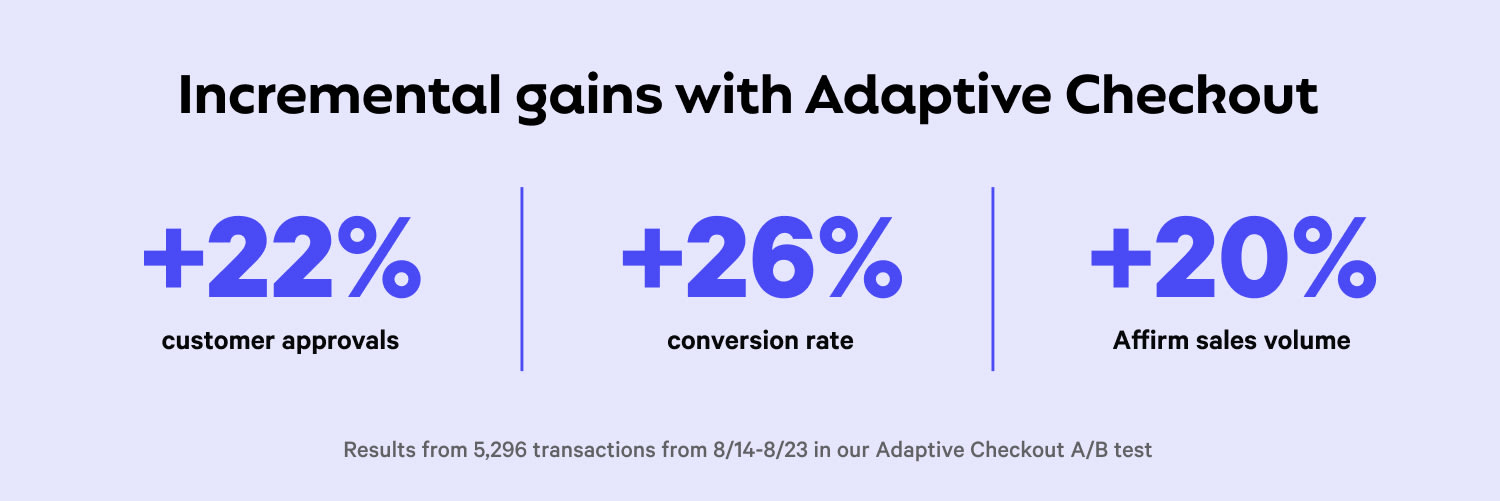

Affirm can accommodate multiple payment preferences in one seamless solution: Adaptive Checkout. You can give shoppers the flexibility to pay the way they want, at more price points. Merchants who implemented this proprietary technology from Affirm saw average gains in customer approvals (+22%), conversion rate (+26%) and Affirm sales volume (+20%).

Whisker, a pet tech company based in Michigan, discovered similar gains after testing Adaptive Checkout in August. “We’ve seen time and time again with Affirm that there’s a direct correlation between more accessible payment options and a higher conversion rate—and that’s awesome,” said Jacob Zuppke, President and COO of Whisker.

BNPL adds more impact to your marketing

Once you’ve added a flexible payment option to your checkout, you can unlock even more benefits by highlighting it on your site and in marketing materials.

With Affirm, for example, you can easily cut-and-paste logos and other marketing assets from our online toolkit. And here’s a simple tip: Display Affirm as low as messaging on product display pages so that shoppers see an easy calculation for what the lower amounts would be when paying over time with Affirm. The added visibility can make a big difference, as SuperATV discovered.

The aftermarket auto business saw a 333% increase in Affirm sales volume after putting Affirm as low as messaging on product display pages. “The integration on the product pages was a piece of cake,” said Josh South, Director of Marketing and Technology at SuperATV.

Here are more ideas for how to gain an advantage by marketing BNPL options to your customers.

Adding BNPL to your site involves minimal effort

Offering BNPL options to your customers is a simple process. You can add it as a plug-in from your existing e-commerce or payments platform like Shopify, Wix, or Adyen. Or you can do a direct tech integration to your site with a BNPL provider like Affirm.

In either case, you don’t have to worry about collecting customers’ payments over long periods of time. Nor do you shoulder the risk of them defaulting on their payment plans.

If your site works with an established e-commerce or payment processing platform, adding a BNPL solution to your site may be as easy as a few clicks. Many BNPL providers, including Affirm, have set up tech configurations with these platforms to give access to merchants. What’s more, many of these platforms also provide resources to help you profit with BNPL, such as this blog post from Wix.

The direct integration option can involve a small amount of tech work. Both Kristin Coffin Jewelry and CEFALY Technologies implemented Affirm in this way, and they described the process as seamless.

“Updating our website is usually a beast of a process, so it was amazing to have the (Affirm) integration process go so seamlessly,” Coffin said. “We saw our first sale via Affirm the day after integration!”

The sales gains may be just as immediate for your business after implementing a BNPL solution. With Affirm, you’ll also gain a partner committed to accelerating your growth with tools to aid your marketing and promotions. Support like that can help expand the size of any business.

Learn more how Affirm can help grow sales for your business.