To help shoppers convert, make checkout a breeze

Every online interaction shoppers have with your brand shapes their digital experience. And each of these interactions, whether they’re planned or incidental, is an opportunity to wow existing and potential customers. This is critical because customers who have great digital experiences are more likely to convert and drive revenue for your brand.

Nowhere is it more important to get your digital experience right than at checkout. At this point in the shopping journey, your customers have committed to their purchases—they want to give you their money! But they won’t hesitate to jump ship at the last minute if checking out is too hard.

Ready to try the buy now, pay later solution that delivers?

Here’s how you can create a seamless checkout experience that drives conversion.

1. Offer guest checkout

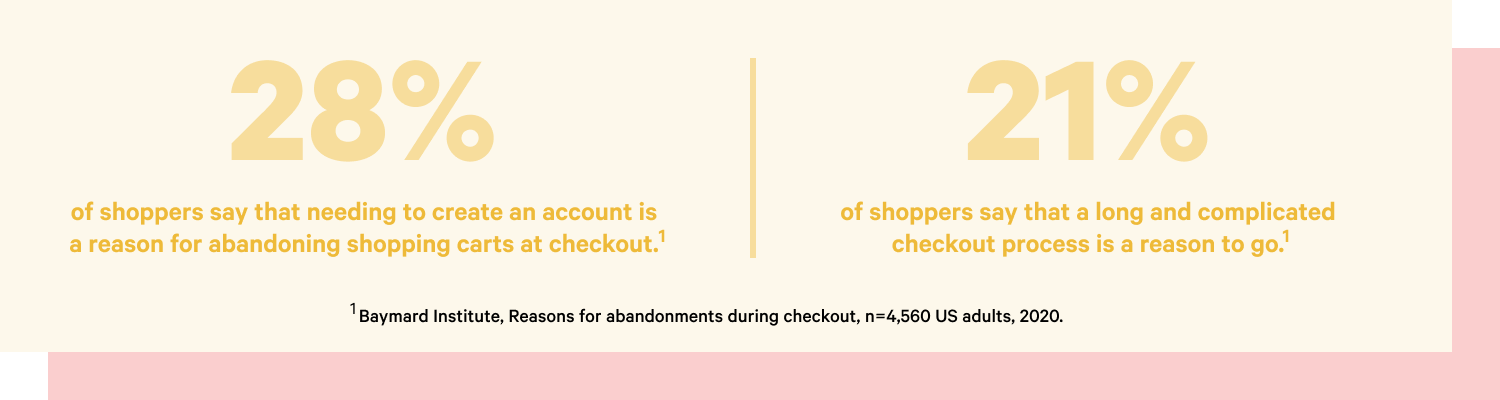

Don’t you hate it when you have to go through the hassle of creating an account and profile when you just want to buy one thing? That’s why it pays to offer a guest checkout option for your customers.

Giving customers a guest checkout option is a great way to start a relationship and nurture them toward brand loyalty—even with guest checkout, you can still offer an email opt-in option. And if you want to encourage them to create an account, use incentives like special deals, members-only advice, and access to experts.

2. Make promotions easy to apply

If you’re going to offer promotions, make sure they can be easily fulfilled at checkout—don’t hide the promo code box! For promotions that are automatically applied, be sure to communicate that up front so customers don’t get confused or frustrated during checkout.

3. Display checkout progress

If your checkout experience lives on multiple pages, consider adding a graphic to show customer progress. Setting expectations can prevent shoppers from getting frustrated and abandoning your site.

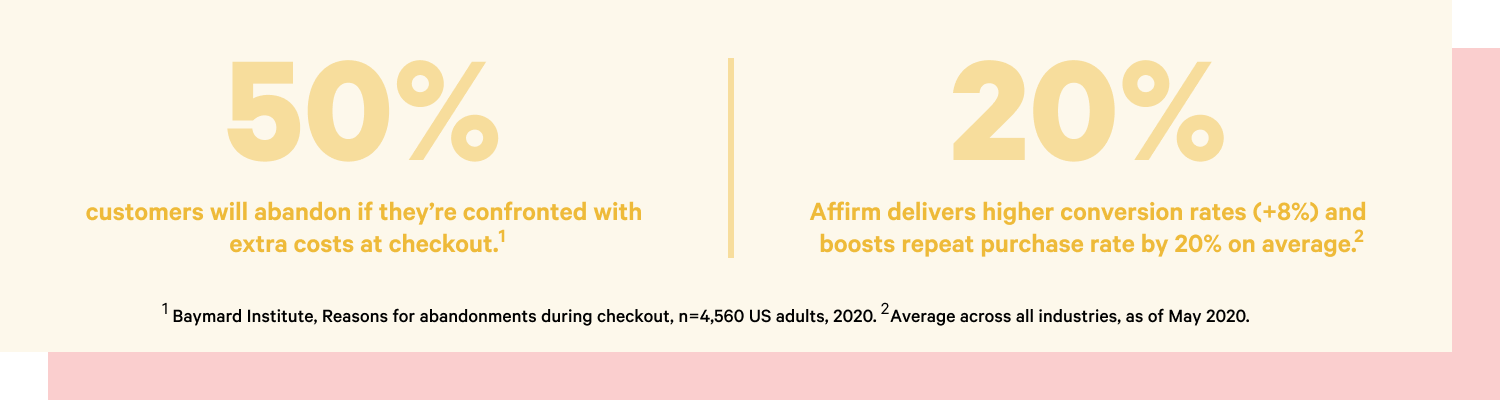

4. No surprises, please

Surprises can be wonderful, but not in the midst of checkout. Be up front with all terms, conditions, and fees so your customers don’t get a nasty shock and leave—about 50% of customers will abandon if they’re confronted with extra costs at checkout.

5. Enable auto-detect and auto-fill

Leverage auto-detect and auto-fill capabilities for shipping address, billing address, and payment information to make checkout as convenient and as fast as possible. This will also make checkout much less tedious if your customers are on a mobile device.

6. Offer multiple payment options

Payment is the final milestone in the checkout process. Make it easy and painless for your customers to add and use whatever their preferred payment method is—be it credit, debit, or your brand’s private label credit card (PLCC). If customers frequently check out on mobile, integrate mobile wallets for their convenience.

Another method to consider offering is paying over time, which is a proven way to accelerate your business. Your customers will benefit by being able to split their purchases into budget-friendly payments, removing price as a barrier. Partnering with a pay-over-time provider, like Affirm, can also benefit your business by helping you attract and convert customers who may not otherwise be in a position to buy right now. In fact, Affirm delivers higher conversion rates (+8%) and boosts repeat purchase rate by 20% on average.

If your brand has a private label credit card (PLCC), don’t worry about a pay-over-time option cannibalizing your PLCC sales. Flexible payments actually complement your brand’s private label credit card.

Check out this example of success

There you have it. Six simple steps that help make checkout a breeze for your customers. If you’re interested in a best-in-class example, look no further than Rad Power Bikes. This Affirm partner incorporates everything we’ve mentioned above—no account required, clear terms and conditions, easy-to-apply promotions, express checkout available, pay-over-time options, and more. Shoppers can go from cart to payment in as few as four steps. And if it’s going to take longer, that’s clearly displayed in the progress bar.

Want to learn more about how to improve your checkout process or any other aspect of your brand’s digital customer experience? Download our playbook, Driving Digital Growth: 5 Steps to Improve Customer Experience and Increase Conversion, today. We’re committed to helping your brand maximize its potential—today, tomorrow, and for years to come.

If you’d like to read more about the changing nature of shopping, check out our blog for the latest advice, trends, and insights. Interested in partnering with Affirm? Get started today!